It’s time to revisit automatic renewal compliance. With California amending its Automatic Renewal Law ("ARL") on September 24, 2024, and the Federal Trade Commission (“FTC”) finalizing its “Click-to-Cancel” Rule (“FTC Final Rule”) on October 16, 2024, retailers across the country should ensure that their practices will offer sufficient protection moving forward.

In California, AB2863 amends the State’s law—still generally the strictest in the country—to incorporate a variety of requirements that have been enacted in other states or considered by the FTC. The amendments take effect July 1, 2025. The FTC’s Final Rule, in turn, largely mirrors the California law, with some subtle exceptions. These amendments take effect January 14, 2025, with Section 425.4 (prohibits the failure to disclose material conditions regarding a product or service) and 425.6 (click to cancel provisions) taking effect May 14, 2025.

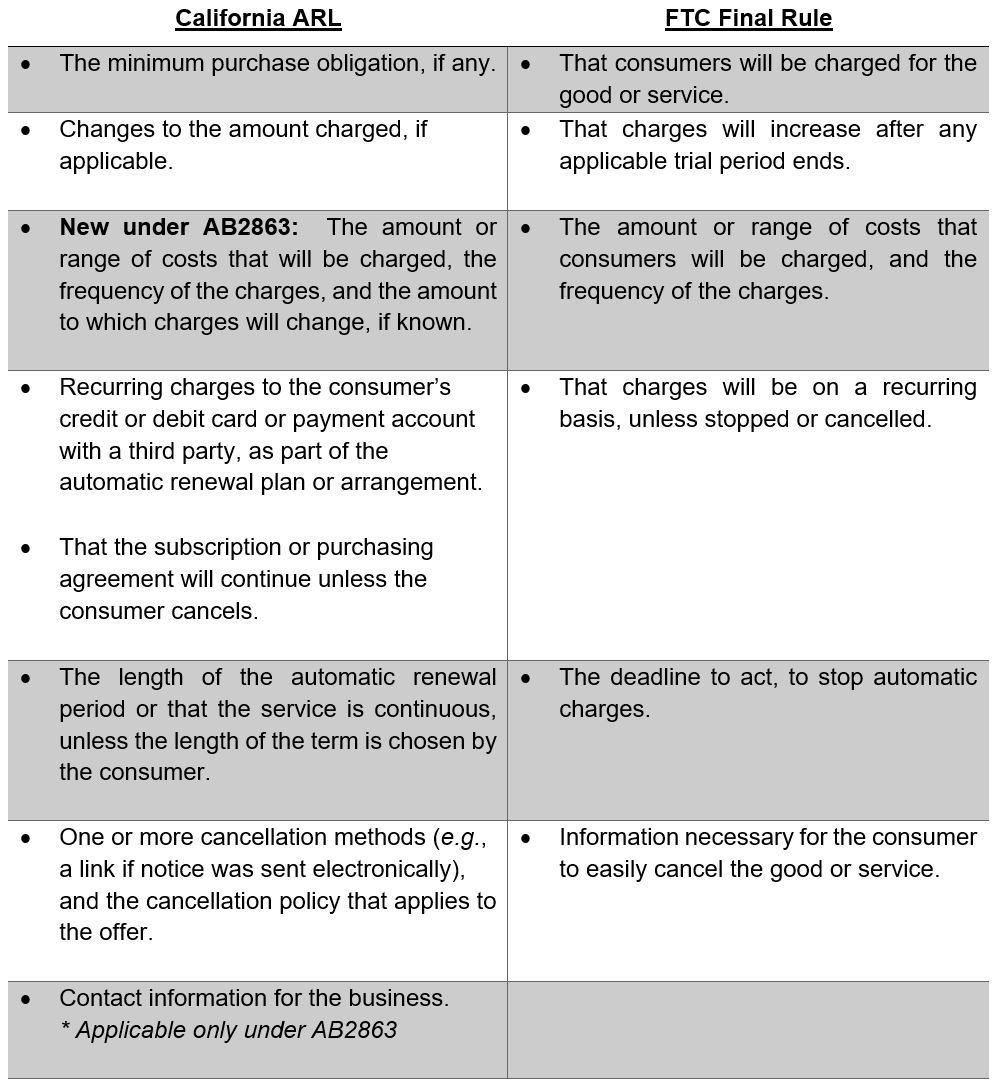

Together, these new requirements, which appear to have inspired each other in several respects, create a stricter-than-ever regime for automatic renewal compliance. The applicable requirements under each authority are:

1. Sign-Up Requirements

Both the California ARL and newly enacted FTC Final Rule require that certain disclosures and notices be “clearly and conspicuously” provided before checkout or before obtaining consumers’ billing information. Although the verbiage between each authorities differs slightly, the requirements are largely consistent. Specifically, companies must disclose:

The California requirements have changed very little since the ARL was first enacted in 2010. Notably, the recent amendments now specifically require companies to disclose the “amount or range of costs the consumer will be charged and, the frequency of those charges a consumer will incur unless the consumer takes timely steps to prevent or stop those charges,” copying nearly verbatim the FTC’s similar requirement.

2. Consent: “Express and Affirmative” in California, “Informed Consent” under the FTC Final Rule

AB2863 requires businesses to obtain “express affirmative consent” prior to enrolling consumers in automatic renewal or continuous service agreements—a step up from the current law’s requirement of “affirmative consent.” Additionally, post-July 1, 2025, businesses must avoid including information “that interferes with, detracts from, contradicts, or otherwise undermines the ability of consumers to provide their affirmative consent” to autorenewal services. The new changes also require merchants to maintain consent records and to verify the consumer’s affirmative consent for at least three years or one year after the contract is terminated, whichever period is longer.

Potential plaintiffs will likely read these provisions as requiring a checkbox, separate button, or other standalone consent device apart from simply agreeing to the transaction—something that the California Automatic Renewal Taskforce (“CART”), a group of several District Attorneys’ offices that has reached numerous big-ticket ARL settlements, has consistently required in consent judgments under previous iterations of the law. Notably, the Ninth Circuit in Hall v. Time, Inc., 2021 WL 2071991 (9th Cir. May 24, 2021) held that a separate consent to the automatic renewal terms was not required, as long as the customer was clearly informed that by placing an order she was agreeing to the automatic renewal terms. The only other state in the country that currently requires a separate consent is Vermont, but only for subscriptions with an initial term of at least one year.

The FTC’s Final Rule requires: “first obtaining the consumer’s affirmative consent to the agreement containing the automatic renewal offer terms.” The FTC’s Final Rule abandons the requirement that consent must be obtained separate from the rest of the transaction, a proposition that was contemplated in the FTC’s Notice of Proposed Rulemaking. Siding with industry concerns, the FTC agreed that this separation “is unnecessary, confusing, and hard to implement.”

The FTC’s Final Rule also imposes record-keeping obligations, requiring verification, like California’s amended ARL does, of consent records to be maintained for at least three years from the date of consent.

3. Cancellation

California’s existing ARL requires companies to allow for a “cost-effective, timely, and easy-to-use mechanism for cancellation,” in the same manner through which the customer signed up. Since 2022, California has required companies to allow customers who sign up online to cancel through either a prominently located direct link or button, or a pre-formatted immediately accessible termination email.

In this newest round of amendments, the Legislature has imposed several new requirements regarding customers who signed up by phone and thus have the right to cancel by phone. In addition, retailers are required to respond to telephonic cancellation requests in a timely manner during normal business hours. When a customer leaves a voicemail requesting to cancel, the company must respond within one business day or “process the requested cancellation or call the consumer back regarding the cancellation request.” In all other circumstances, cancellations should be addressed without unnecessary “‘obstruct[ion]’ or delay.”

The FTC’s Final Rule largely adopts California’s existing and new requirements, mandating “simple” cancellation through the same means used to enroll. Although the FTC’s Final Rule does not exactly require an easy to find link or button in a consumer’s account, it expects marketers to provide other easy cancellation mechanisms. If consent was provided through an “interactive electronic medium” (including mobile application, chat, email, messaging, or Internet website), cancellation should also be made easy to find or readily accessible through the same medium the consumer used to consent to the subscription feature. And the consumer cannot be required to interact with live or virtual chatbots if they did not do so when they consented. For telephone cancellations, consumers must have access by calling during “normal business hours” to effectuate cancellation.

4. “Save Attempts”

In the good news category, AB2863 and the FTC’s Final Rule both expressly allow for so-called “save attempts”—whereby a retailer offers the customer special deals or other perks to induce them to continue their subscriptions—at least when certain requirements are met.

The current ARL requires cancellation to be available “at will, and without engaging any further steps that obstruct or delay the consumer’s ability to terminate the automatic renewal or continuous service immediately.” Private plaintiffs and CART have argued that this language prohibits retailers from offering customers a discount to deter them from cancelling.

The amended ARL clarifies that “providing a discount offer or other consumer benefit or informing a consumer of the effect of the cancellation shall not be considered an obstruction or delay.” Online, however, the business must simultaneously display a “prominently located and continuously and proximately displayed direct link or button” that says “click to cancel” or similar language, that allows for immediate cancelation. And, if the request to cancel is by telephone, the business must first clearly and conspicuously inform the consumer that they may complete the cancellation process at any time by stating that they want to “cancel” or words to that effect, and promptly process the cancellation upon notice of the request.

5. Annual Reminders

AB2863 imposes a new requirement for merchants to send annual reminders about any autorenewal or continuous service agreement, regardless of the length of the renewal period. Previously (Assembly Bill No. 390, 2021), an annual notice was only required for subscriptions with an initial renewal period of a year or more (several other states—e.g., Illinois, New York, Vermont, District of Columbia—have similar requirements).

The amendment specifies that reminders should be sent in the same medium through which the customer signed up or is otherwise accustomed to interacting with the business, and should include:

- The product or service that will be automatically renewed;

- The frequency and amount of charges; and

- Instructions and a means to cancel.

In 2022, a similar notice requirement took effect in Colorado.

6. Notice of Fee Changes

California’s ARL has long required companies to provide notice to customers of any material changes to their subscriptions, but it has previously lacked details concerning the timing or nature of such notice. Additionally, existing law requires disclosures at sign-up providing “that the amount of the charge may change, if that is the case, and the amount to which the charge will change, if known.”

AB2863 provides more specific notice requirements for when the amount(s) a consumer will be charged under an existing subscription will change. In such cases, the business must provide notice between 7 and 30 days before the change takes effect. That notice must provide clear and conspicuous disclosure of the fee change, and information regarding how to cancel in a manner that is capable of being retained by the consumer.

7. Material Misrepresentations are Prohibited

The amended ARL and FTC’s Final Rule each broadly prohibit any misrepresentation (express or implied) of “material fact[s]” regarding automatic renewal services. The FTC’s Rule defines misrepresentations as actions that are likely to affect consumers’ choice of, or conduct regarding, goods or services.

When the FTC first proposed this requirement in the draft of the Negative Option Rule, industry groups expressed concern that this broad restriction would create liability for conduct largely unrelated to a company’s subscription services, such as when retailers sell products provided by third party vendors. In those instances, retailers could be forced to face steep penalties for negligent misrepresentations (e.g., concerning product efficacy; health or safety), based on information provided by a third party, and despite the business taking great care. Others found the restriction to be inconsistent with safeguards that require the “contours of the ‘specificity’” requirement to be precisely defined with respect to what constitutes material misrepresentations. The FTC included this provision in the Final Rule notwithstanding these concerns.

Risk of Non-Compliance

Even though the California Court of Appeal has held that the ARL does not have a private right of action, numerous ARL-related lawsuits are filed each year through the Unfair Competition Law, which allows customers to bring “unlawfulness” claims based on ARL violations—as long as the customer can establish that they suffered an economic injury due to the violation (as required for UCL standing). The largest risk in California, however, is CART, which has obtained various high value settlements over the last decade, including: Thrive Market (April 2024 -- $1,100,000 in civil penalties and costs, plus $450,000 in restitution); Relaxium.com (August 2023 -- $900,000 in civil penalties and $1,300,000 in restitution); NakedWines.com Inc. (September 2022 -- $650,000 in civil penalties and costs); Relish Labs LLC (January 2021 -- $200,000 in civil penalties and costs, plus $250,000 restitution); Match Group, Inc. (November 2020 -- $2,028,500 in civil penalties and costs); eHarmony, Inc. (January 2018 -- $1,280,000 in penalties and costs, plus up to $1,000,000 in restitution); AdoreMe, Inc. (August 2018 -- $600,000 in civil penalties and costs, plus at least $450,000 restitution); Beachbody, LLC (August 2017 -- $2,579,000 in civil penalties and costs, plus $1,000,000 in restitution).

On the FTC side, the Commission has authority to seek $10,000 for each violation of the FTC’s Final Rule, pursuant to Section 5(a) of the FTC Act, 15 U.S.C. Sec. 45(a), which prohibits unfair or deceptive acts or practices. Even before the Final Rule, however, the FTC can bring claims under the federal Restore Online Shoppers’ Confidence Act (“ROSCA”)—to obtain civil penalties of up to $51,744 per violation—which it has done on several occasions in recent years. See, e.g., FTC v. Amazon.Com, Inc., 2024 U.S. Dist. LEXIS 184762 (W.D. Wash.) (set for 2025 trial); United States v. Adobe, Inc., 2024 U.S. Dist. LEXIS 130076 (N.D. Cal.) (referral by the FTC to the Department of Justice; defendants’ motion to dismiss is currently pending oral argument; parties may pursue private mediation); In re MoviePass, Inc. (2021) (reporting and compliance consent order was entered); FTC v. AAFE Products Corporation (S.D. Cal. 2017) ($2.5 million to settle charges. In 2020, the FTC announced $488,629 in refund checks back to consumers who bought “risk-free” trial products).

Conclusion

The last time California amended the ARL, a number of states followed suit. The FTC’s increased focus on this area this year may lead to further reverberations throughout the country. Therefore, it is especially crucial for retailers to get ahead of AB2863, the FTC’s published Final Rule, and other new laws likely on the way.

For more information, please contact a member of Benesch’s Retail & E-Commerce industry team, along with our Litigation Practice Group:

Stephanie A. Sheridan at ssheridan@beneschlaw.com or 628.600.2266

Meegan Brooks at mbrooks@beneschlaw.com or 628.600.2232

Ruddy S. Abam at rabam@beneschlaw.com or 312.212.4949